Want to Build Wealth Steadily? Here's the Mutual Fund Blueprint

Explore how mutual funds help you grow wealth consistently. Learn the types of funds, SIP steps, and essential tools like mutual fund calculators to make smart investment decisions.

Planning your financial future begins with thoughtful decisions and consistent habits. Mutual funds have emerged as a popular choice for investors seeking long-term growth with manageable risk. Whether you're setting goals, exploring SIPs, or tracking your portfolio's progress, having the right tools can make a real difference. One such helpful tool is the mutual fund returns calculator, which lets you quickly estimate your potential gains based on your investment details.

What Makes Mutual Funds a Must-Know Investment Tool?

Mutual funds are investment vehicles that pool money from various investors to purchase a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professionals who aim to generate returns while managing risk. As an investor, you benefit from

Diversification: Mutual funds spread investments across different asset classes to reduce risk.

Professional Management: Fund managers make informed decisions based on market analysis.

Liquidity: Most mutual funds allow easy redemption, making it simple to access your funds when needed.

Tax Savings: Tax-saving mutual funds, especially Equity Linked Savings Schemes (ELSS), provide the dual benefit of wealth creation and tax relief. Under Section 80C, you can claim deductions up to ₹1.5 lakh annually.

Beginner’s Guide to Investing in Mutual Funds in India

There are several straightforward ways for beginners in India to start investing in mutual funds. Here’s how you can go about it:

1. Through the AMC Website

Investing directly via an Asset Management Company (AMC) website is convenient and available both online and offline. To begin, you will need to open a new account by providing your personal details and submitting your bank information. Your KYC will be verified using your Aadhaar, and you’ll need to upload a photo of a cancelled cheque. Once this is done, you can transfer funds to begin investing.

2. Offline Process

If you prefer offline investing, visit the nearest AMC office. Submit the required application form along with your KYC documents and payment. The AMC staff will assist you with completing the process.

3. Using Demat Accounts

Many investors also use their existing Demat accounts to invest in mutual funds. This option requires no extra setup—your current Demat and linked bank accounts can be used seamlessly. Simply log in to your Demat account, select the mutual fund investment option, choose your desired fund, and complete the online payment to start investing.

Kickstart Your SIPs with These Simple Steps

Complete KYC: Fill out the online form and submit self-attested ID and address proof.

Select a Fund: Visit the mutual fund house’s website and choose a suitable SIP plan.

Register Online: Provide your name, phone number, PAN, and create a login ID.

Set Up Bank Details: Enter your bank info and authorise auto-debit for monthly SIP.

Make First Payment: Pay the first SIP instalment online to start the plan.

Follow AMC Schedule: The second payment is auto-debited after 30 days, as per AMC instructions.

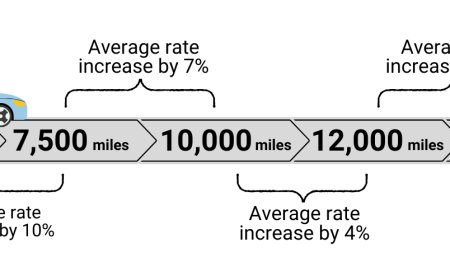

To plan better, use a Step Up SIP Calculator. It estimates future SIP value by factoring in regular contribution increases, helping align investments with growing income and goals.

Types of Mutual Funds That Match Your Financial Vision

Before investing, it helps to understand the major fund categories. Each type is designed to meet different risk appetites and goals.

1. Equity Funds

These invest in shares of companies and are ideal for long-term goals. They carry higher risk but also offer higher return potential.

2. Debt Funds

These funds invest in fixed-income securities such as bonds, offering more stability and making them ideal for short to medium-term financial goals.

3. Hybrid Funds

Combining both equity and debt, hybrid funds offer a balanced approach to risk and return, making them well-suited for cautious investors.

4. Index Funds

These funds track market indices and are passively managed, providing broad market exposure with lower management fees.

5. Contra Funds

If you're wondering what is contra fund, it's a type of equity mutual fund that takes a contrarian approach to investing. Fund managers pick undervalued, unpopular stocks with long-term growth potential—ideal for patient investors with higher risk tolerance.

Smart Checks Before You Commit to a Fund

Before investing in a mutual fund, it's essential to assess various factors to ensure it aligns with your financial goals and risk appetite.

Fund Performance: Review the fund’s performance over the past 3–5 years. Compare it against its benchmark and similar funds to check for consistency.

Net Asset Value (NAV): NAV indicates the price of one unit of a mutual fund. A lower NAV doesn’t always mean it’s better—look at the fund’s overall quality and growth potential.

AMC Performance: Verify the credibility and track record of the Asset Management Company (AMC). A well-managed Asset Management Company (AMC) often reflects better fund management.

Fund Manager Experience: Look into the fund manager’s qualifications and track record. A skilled manager can make a big difference in how your fund performs.

Expense Ratio: This is the annual fee charged by the fund. It’s usually between 1% and 2%, and it directly affects your returns.

Exit Load: Some funds charge a fee if you exit early. Make sure you're aware of any such costs.

Assets Under Management (AUM): A high AUM indicates trust from a larger investor base and often points to fund stability.

Tax Implications: Gains from mutual funds are taxable. Understand whether your fund falls under equity or debt taxation rules to avoid surprises later.

Liquidity: Check for lock-in periods, exit loads, and the fund's redemption processing speed.

Mutual Fund Tips Every New Investor Should Follow

If you're just starting, here’s a quick guide to help you make smart decisions:

1. Define Your Financial Goals

Whether it’s buying a house, saving for your child’s education, or retirement, knowing your goal determines how much to invest and where.

2. Choose the Right Fund Type

Start with low-risk debt or balanced funds. As your comfort level increases, consider moving to equity or hybrid options.

3. Don’t Overload on One Fund

Spread your money across different types to reduce risk and smooth returns.

4. Use SIPs for Consistency

SIPs instill investing discipline and let you benefit from rupee cost averaging. Use a SIP calculator to plan your monthly contributions smartly and forecast potential returns over time.

5. Stay Invested

Give your investments time to grow. Avoid reacting to short-term market fluctuations.

Conclusion

Successful investing begins with informed choices and reliable tools. A Mutual Fund App, simplifies tracking, planning, and managing investments—all from your phone. Start your journey with confidence, stay consistent, and let your SIPs grow steadily over time. With the right habits, your financial goals are well within reach.