How Driving Frequency Impacts Your Policy in Salt Lake City

Driving less in Salt Lake City? Learn how low-mileage habits can reduce your car insurance premiums and discover usage-based programs that reward safe, infrequent driving.

How often you drive plays a bigger role in your car insurance premium than many people realize. Insurance companies evaluate driving frequency as a major risk factor—after all, the more time you spend on the road, the higher the likelihood of an accident.

For residents of Salt Lake City, where commuting habits vary widely between city-center workers and remote employees, understanding this factor can unlock significant savings. Drivers who cover fewer miles each year may qualify for special low-mileage insurance benefits Utah insurers now offer.

Why Insurers Care About Mileage

Insurance companies use mileage as a predictor of risk. More miles driven means:

-

Increased exposure to potential accidents

-

Higher chances of wear-and-tear claims

-

More time navigating traffic and unpredictable weather conditions

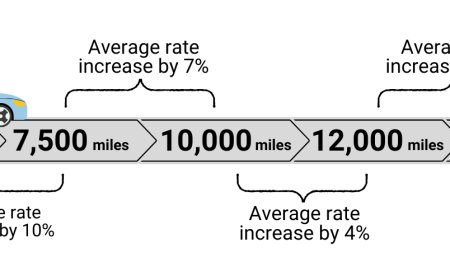

Conversely, a driver who only uses their vehicle for occasional errands or weekend trips represents a lower risk. That’s why many insurers offer discounts for drivers who stay under a certain annual mileage threshold, often around 7,500–10,000 miles per year.

Types of Low-Mileage Programs in Utah

If you drive less than the average motorist, you could benefit from:

-

Pay-per-mile insurance – Ideal for those who only drive occasionally, you pay a base rate plus a small fee for each mile driven.

-

Usage-based telematics programs – These monitor your driving habits through an app or device, rewarding low-mileage, safe driving patterns.

-

Annual low-mileage discounts – Some companies simply ask for an odometer reading during renewal and adjust your rate accordingly.

These programs are especially attractive for retirees, remote workers, or households with multiple vehicles that aren’t all used daily.

Salt Lake City Commuting Patterns Matter

Driving frequency in Salt Lake City varies greatly depending on where you live and work. Someone who commutes daily on I-15 or I-80 will have higher risk exposure compared to a driver who relies mostly on public transportation and uses their car sparingly.

Understanding your actual driving habits can help you pick the most cost-effective policy. If your insurer assumes you’re a heavy commuter when you’re not, you may be overpaying.

How to Maximize Savings as a Low-Mileage Driver

To ensure you’re getting the best possible rate:

-

Track your mileage and share accurate odometer readings with your insurer.

-

Ask about telematics discounts to prove your low driving frequency.

-

Compare quotes from multiple insurers, as low-mileage benefits vary widely.

-

Bundle your policies—if you’re already a low-risk driver, combining auto and home coverage can unlock even more discounts.

Final Thoughts

For many Salt Lake City residents, driving less can translate into substantial insurance savings. Whether it’s due to remote work, limited travel needs, or simply lifestyle changes, low-mileage drivers have a strong case for reduced premiums.

If your driving frequency has changed recently, it’s worth contacting your insurer to see if you’re eligible for new discounts—or even switching to a pay-per-mile plan to match your current habits.